Bank of the Philippines Islands (BPI) is the oldest bank in the Philippines, established in 1851. It is considered as one of the most stable and safe place to put your hard earned money.There are numerous banks now but still BPI is one of the leading and trusted bank. It already gain credibility through the years.

In choosing at where to open a savings account, I think BPI must be on your top pick. Personally I have a great experience with BPI specially when it comes to customer support . Today, I will show you the procedure on how to apply or open a BPI savings account.

Here are the requirements and step-by-step process in opening or applying for a BPI Savings Account(ATM & Passbook Account):

a. Two (2) valid ID's and photocopy of them.

- Passport

- Driver’s license

- Professional Regulations Commission (PRC) ID

- National Bureau of Investigation (NBI) clearance

- Police clearance

- Postal ID

- Voter’s ID

- Barangay certification

- Government Service and Insurance System (GSIS) e-Card

- Social Security System (SSS) Card

- Philhealth Card

- Senior Citizen Card

- Overseas Workers Welfare

- Administration (OWWA) ID

- Overseas Filipino Worker ID

- Seaman’s Book

- Alien Certification of Registration/Immigrant Certificate of Registration

- Government office ID: (e.g. Armed Forces of the Philippines (AFP), Home Development Mutual Fund (HDMF) IDs)

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP)

- Department of Social Welfare and Development (DSWD) Certification

- Other valid IDs issued by the Government and its instrumentalities

Note : Bring atleast 1 photo bearing ID and another valid ID.

b. Billing Statement

- Utility Bill

- Credit Card Bill, etc.

c. Two (2) pieces latest 1x1 photo

d. Initial Deposit

- 500 pesos (3,000 maintaining balance) for ATM Savings Account

- 10,000 pesos for Passbook Savings Account

2. Fill out the application forms. All the information you provided must be ACCURATE.

3. Wait for your savings account to be activated usually one day. You can go back to the bank within a week to get your opening kit if not still available during your enrollment. On my experience I already get my passbook.

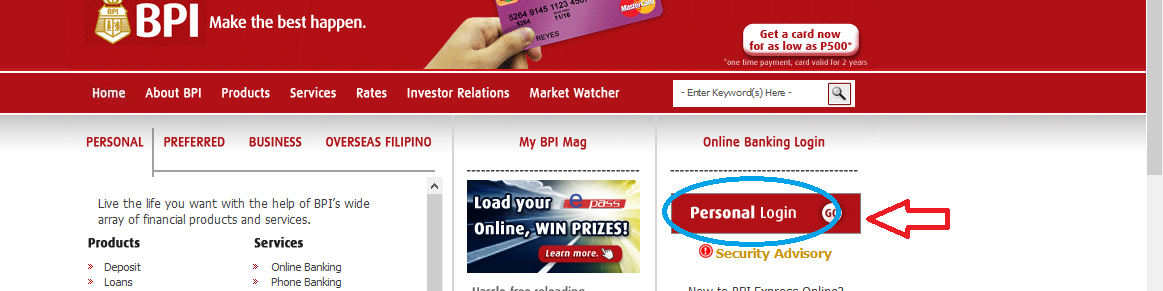

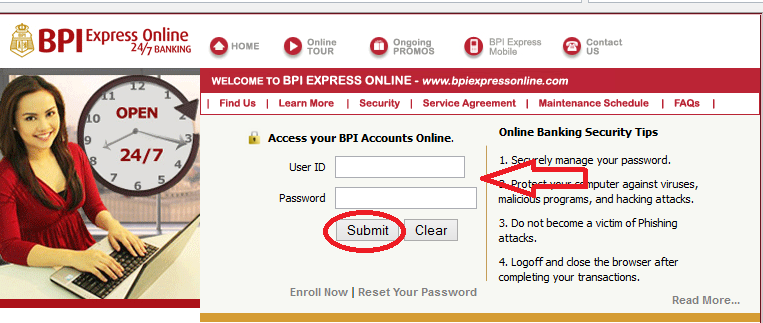

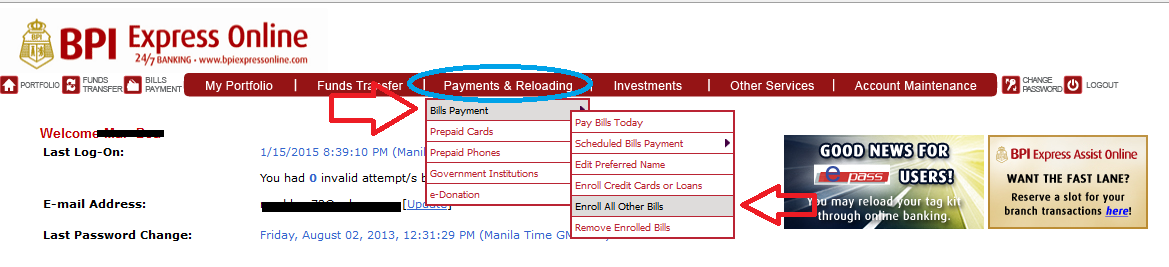

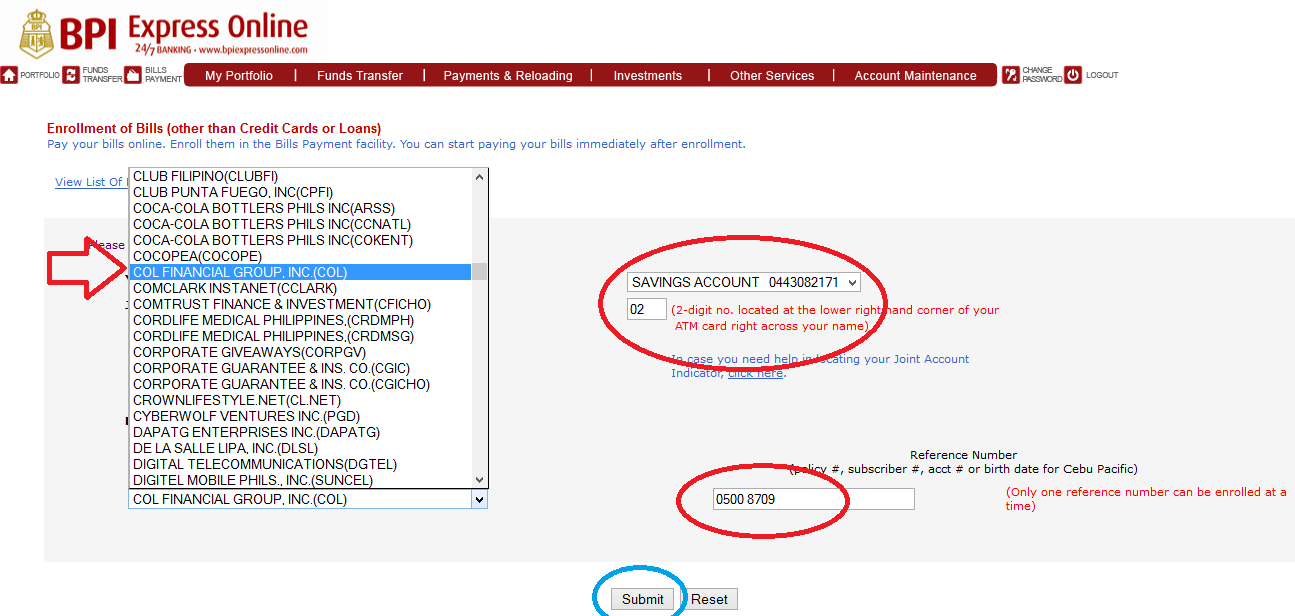

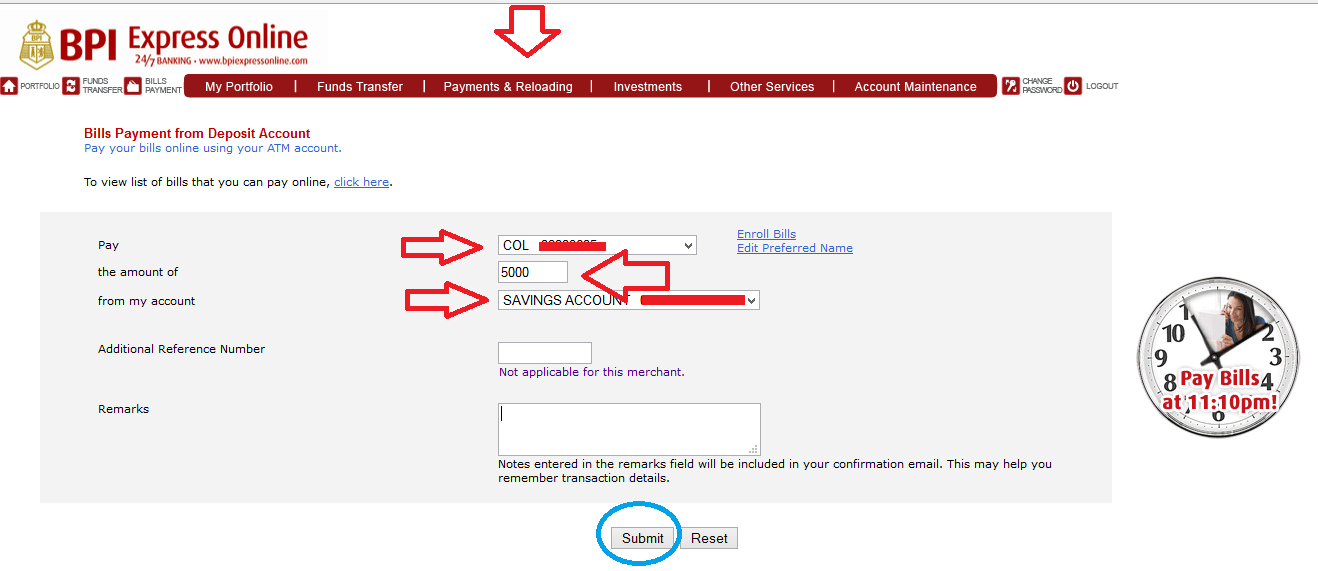

4. Activate phone and online banking.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)